Silver Spoon Baby™ Plan – Invest in your child’s future

You can use the funds in the plan, while it continues to grow.

The Silver Spoon Baby™ Plan is an asset class of life insurance called participating whole life insurance. Each policy has a guaranteed cash value and every year, a tax-free dividend is paid into this cash value. These policies have existed since 1847, and a dividend payment has never been missed.

Choose Your Plan

We offer plans to suit every familie's needs and budget. Below are 3 different case scenarios for a 1- year old boy.

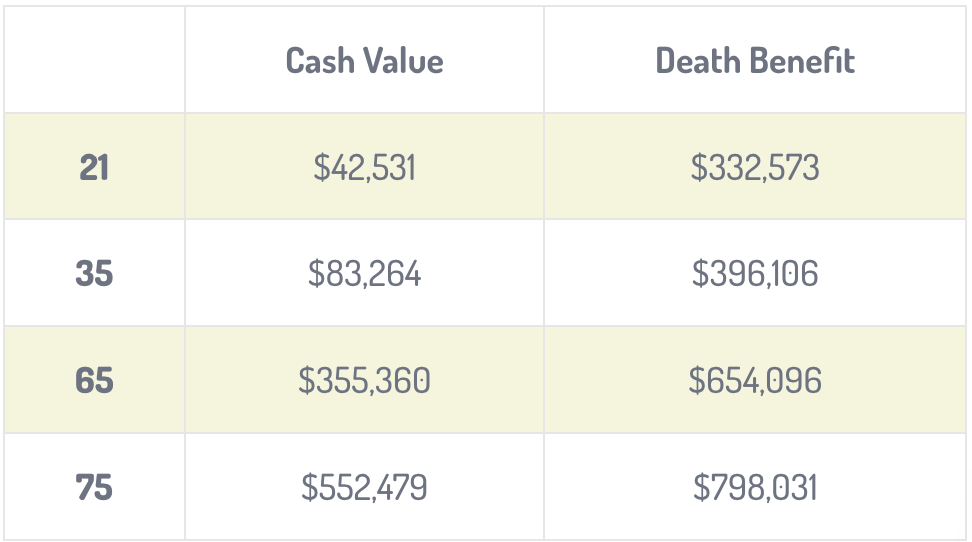

Plan A: $150/mo from age 1 to age 21

*Sample illustration is based on a $ 150 monthly premium for twenty years starting when the child is less than 1. Cash and life insurance values are based on a current dividend scale of 6.2% from a Canadian Life Insurance Company. This example is strictly for illustration purposes only.

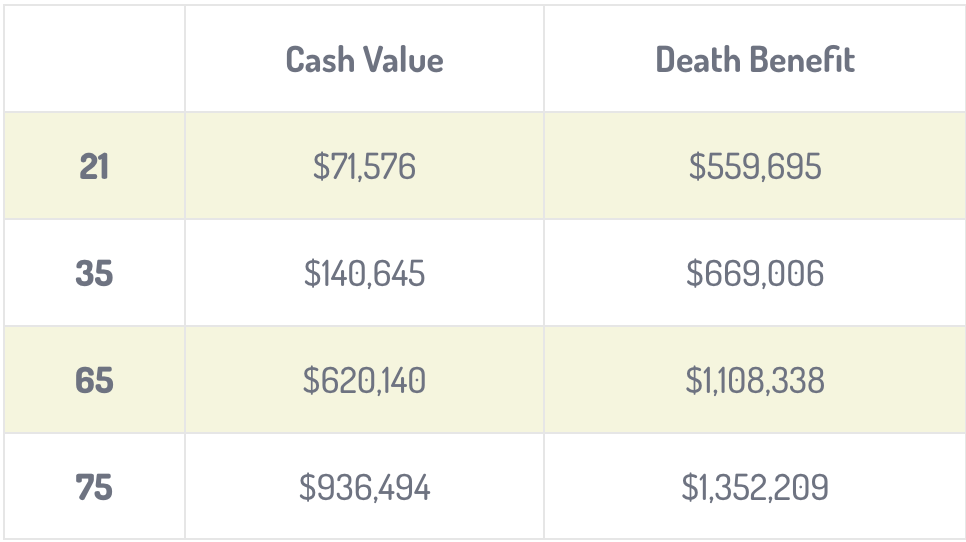

Plan B: $200/mo from age 1 to age 21

*Sample illustration is based on a $ 200 monthly premium for twenty years starting when the child is less than 1. Cash and life insurance values are based on a current dividend scale of 6.2% from a Canadian Life Insurance Company. This example is strictly for illustration purposes only.

Plan C : $500/mo from age 1 to age 21

*Sample illustration is based on a $ 500 monthly premium for twenty years starting when the child is less than 1. Cash and life insurance values are based on a current dividend scale of 6.2% from a Canadian Life Insurance Company. This example is strictly for illustration purposes only.

Silver Spoon Plan

Tax advantages growth.

Borrow funds from the cash value for different milestones in life.

This is an asset that either you, or your child, can use for retirement.

It’s completely funded after a 20-year period. No further deposits are required.

Steady, predictable growth*

Ownership can be handed over to the child at any time, tax free, after they turn 18

We serve clients across BC, Alberta & Ontario

MORE DETAILS

Why choose a Silver Spoon Baby™ Plan?

Uninterrupted compound growth

You can use the funds in the plan, while it continues to growth. Save and spend at the same time.

Cash values

Can be used by your child for any financial need in life including education, down payment on a home, starting a business and even to provide financial security for their future family

Permanently Covered

Because it’s a life insurance plan, your child will be permanently covered, regardless of any illness that may arise in the future. Lock in your childs health today.

Book an appointment today and meet with us for a complimentary no-obligation education and discovery meeting.

Ask us about how with INFINITE BANKING you can have your cake and eat it too!

Our Team Of Experts Specialize in the following:

Infinite Banking, Whole Life Insurance, Universal Life Insurance, Term insurance, Key Man Insurance, Buy-Sell Agreements, Corporate Insurance, Mortgage Insurance, Critical Illness Insurance, Disability Insurance, Group Health Insurance, Silver Spoon Baby Plan, New Immigrant Life Insurance, Financial Planning Services.

Testimonials

Tomas W.

Lucas Chen

Aiden Li